2026: A Year of Opportunities, Challenges, and Smart Positioning

As we step into 2026, investors are entering one of the most dynamic market phases of the decade.

Global uncertainty, strong domestic fundamentals, rising consumption, and rapid technological transformation are all shaping the path ahead.

The question every investor is asking is:

“What should I expect from 2026 — and how do I prepare?”

Let’s break down the outlook in a simple, visually engaging, and client-friendly way.

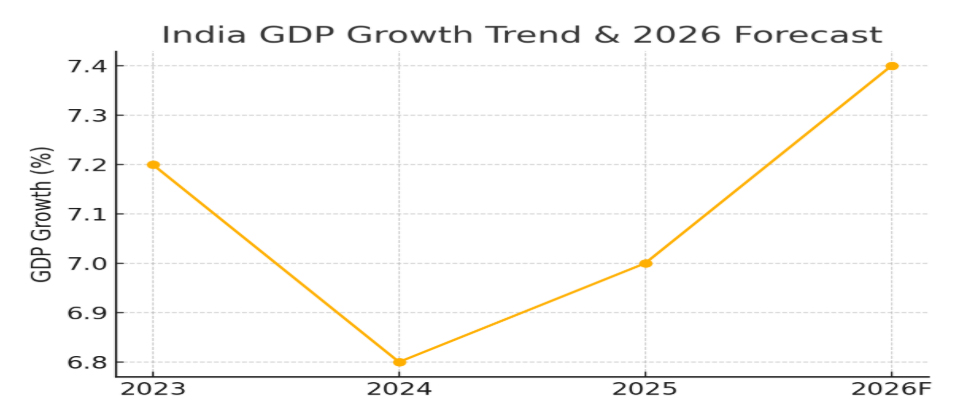

- India’s Growth Engine Stays Strong

India remains one of the fastest-growing major economies in the world.

Despite global slowdowns, the domestic economy shows resilience and upward momentum.

India GDP Growth Trend & Forecast

What’s driving this growth?

- Robust domestic consumption

- Healthy government and private capex

- Manufacturing push through PLI schemes

- Expanding credit cycle

- Global companies shifting supply chains to India

Investor takeaway:

India remains a long-term growth story. Equity allocation should continue to play a central role in wealth building.

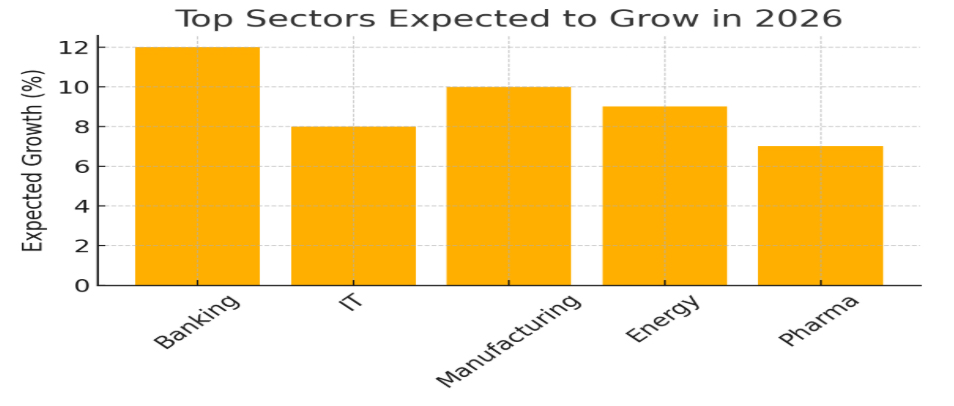

- Top Sectors Expected to Outperform in 2026

Not every part of the market will grow at the same pace.

Here are the sectors most likely to drive returns:

High-Opportunity Sectors for 2026

🔹 Banking & Financials

Lower NPAs + credit expansion = strong profitability.

🔹 Manufacturing & Capital Goods

Industrial growth, automation, and infrastructure spending will boost earnings.

🔹 Energy & Renewables

Solar, EVs, battery storage, and green hydrogen will remain major themes.

🔹 IT & Digital Services

AI, cloud, and cybersecurity will drive the next leg of growth.

🔹 Pharma & Healthcare

Global outsourcing, specialty drugs, and health consumption are rising.

Investor takeaway:

A diversified portfolio with exposure across these sectors can deliver consistent growth through 2026.

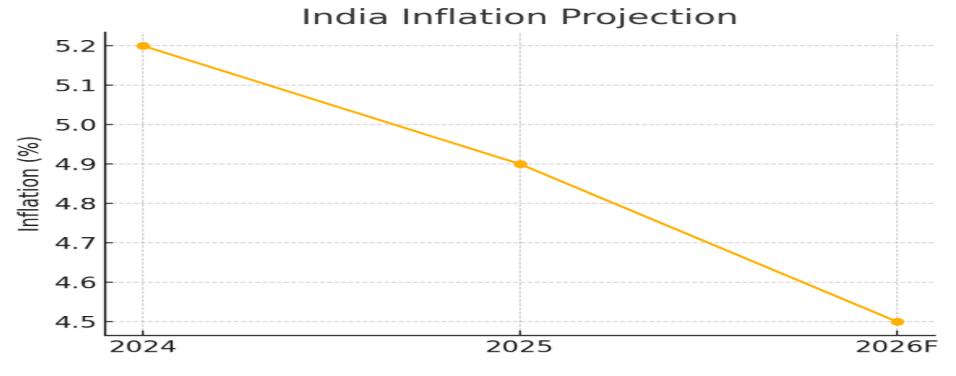

- Inflation Is Cooling — A Relief for Investors

Inflation plays a major role in determining interest rates, loan costs, and investment returns.

Luckily, the inflation trend looks positive:

India Inflation Projection

What does lower inflation mean for you?

- Better purchasing power

- Potential for rate cuts

- Stronger bond market performance

- More stable equity markets

Investor takeaway:

2026 may be a strong year for debt funds, especially longer-duration categories.

- Global Risks Still Exist — But India Is Better Prepared

Here are key global factors impacting markets:

- US elections and policy shifts

- China slowdown

- Oil price volatility

- Geopolitical tensions

- Global interest rate cycles

But India stands out because:

- Forex reserves are at record highs

- Banks are healthier than ever

- Domestic consumption is rising

- Manufacturing is expanding

- Digital economy is booming

Investor takeaway:

Temporary volatility ≠ Long-term risk.

India’s resilience is stronger today than at any time in the last decade.

🧠 5. How Smart Investors Should Prepare for 2026

Here’s a simple, actionable checklist:

✔ Stay invested — don’t try to time the market

✔ Increase SIPs during volatility

✔ Review asset allocation

✔ Avoid high-risk “quick return” products

✔ Strengthen your emergency fund

✔ Seek professional advice

2026 Will Reward the Prepared, Not the Fearful

2026 is shaping up to be a year of:

- Strong economic growth

- Cooling inflation

- Sectoral opportunities

- Promising market cycles

Smart investors will:

- Stay calm

- Stay consistent

- Stay diversified

- Stay long-term

And most importantly:

Stay guided. Stay informed. Stay invested.Whenever you need clarity, evaluation, or portfolio guidance —

your Opulence Wealth team is here to simplify your financial journey.